Zero-Knowledge Infrastructure for Finance.

Verify financial claims without exposing sensitive data.

© 2026

22'

BLIND TRUST

Accept claims at face value.

“My strategy returned 40% last year."

"This user passed KYC elsewhere."

"Our model used licensed data."

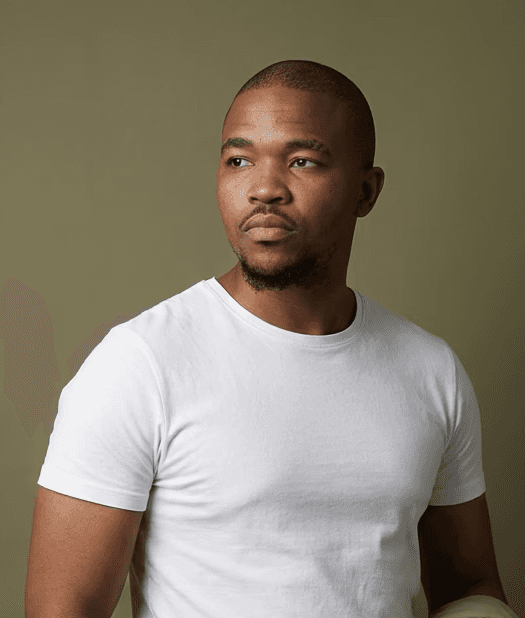

For example, to prove you're an accredited investor, you typically hand over tax forms, bank statements, or brokerage records to a third party and wait for manual review. With zero-knowledge proofs, you prove 'I meet the threshold' and nothing else. The verifier gets instant certainty. You keep your data private.

Built for the agentic financial layer. Proofs generate in the user's browser. Sensitive data never touches our servers.

Sensitive data sent to server

0 bytes

Your platform ←→ Mirror

Three API calls. Clear documentation. No blockchain knowledge required.

24/7

From accredited investor to AML to forecasting to custom compliance logic, you define the claim.

We build the circuit.

New Circuit Deployment

12-36h

From request to production.

Mirror's API lets you verify regulatory compliance without touching sensitive data. Pre-built circuits for common use cases. Custom circuits for complex requirements. One integration, endless applications.

What You Can Prove

Accredited investor status

AML/sanctions compliance

Portfolio diversification

Net worth thresholds

Regulatory reporting

Qualified purchaser status

Forecast track records

Agent credentials

Who Integrates

Fintechs

Exchanges

Trading platforms

Fund administrators

Compliance teams

Banks

Prediction markets

Broker-dealers

AI agent platforms

Forecast aggregators

Not finding what you need?

Reach out anytime.